Outstanding Tips About How To Apply For The Home Tax Credit

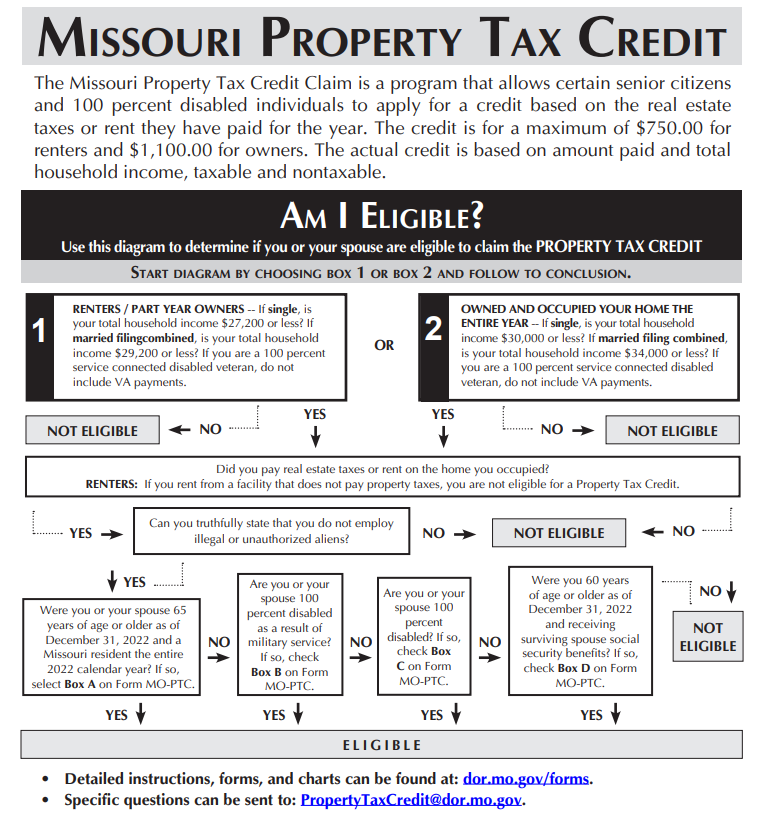

The missouri property tax credit is worth as much as $1,100.

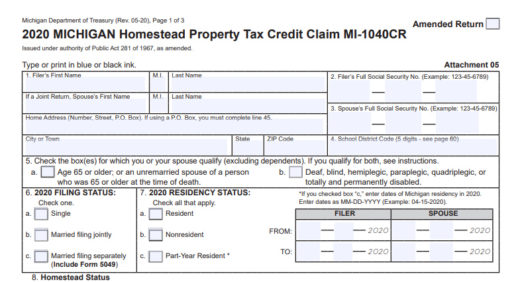

How to apply for the home tax credit. Under the direction of the regional manager, the community manager supports and assists in all aspects of community operations. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home heating. The state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income.

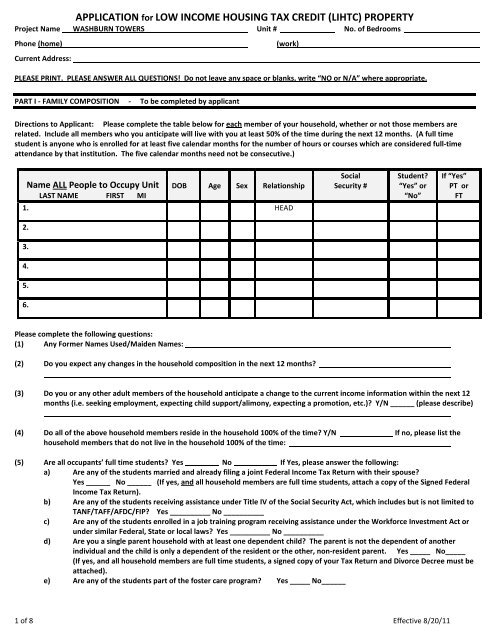

Household information (including name, gender, date of birth, and social security number, income and assets). You must enter your property number exactly as it appears on your. Department of assessments and taxation homestead tax credit division 301 west preston.

You’ll need to update your. You do not necessarily have to be a homeowner to claim the tax credit. The credit decreases over six years, as follows:

You have 4 years from the original due date to file your claim. Please see additional details below on the role. You can only make a claim for child tax credit or working tax credit if you already get tax credits.

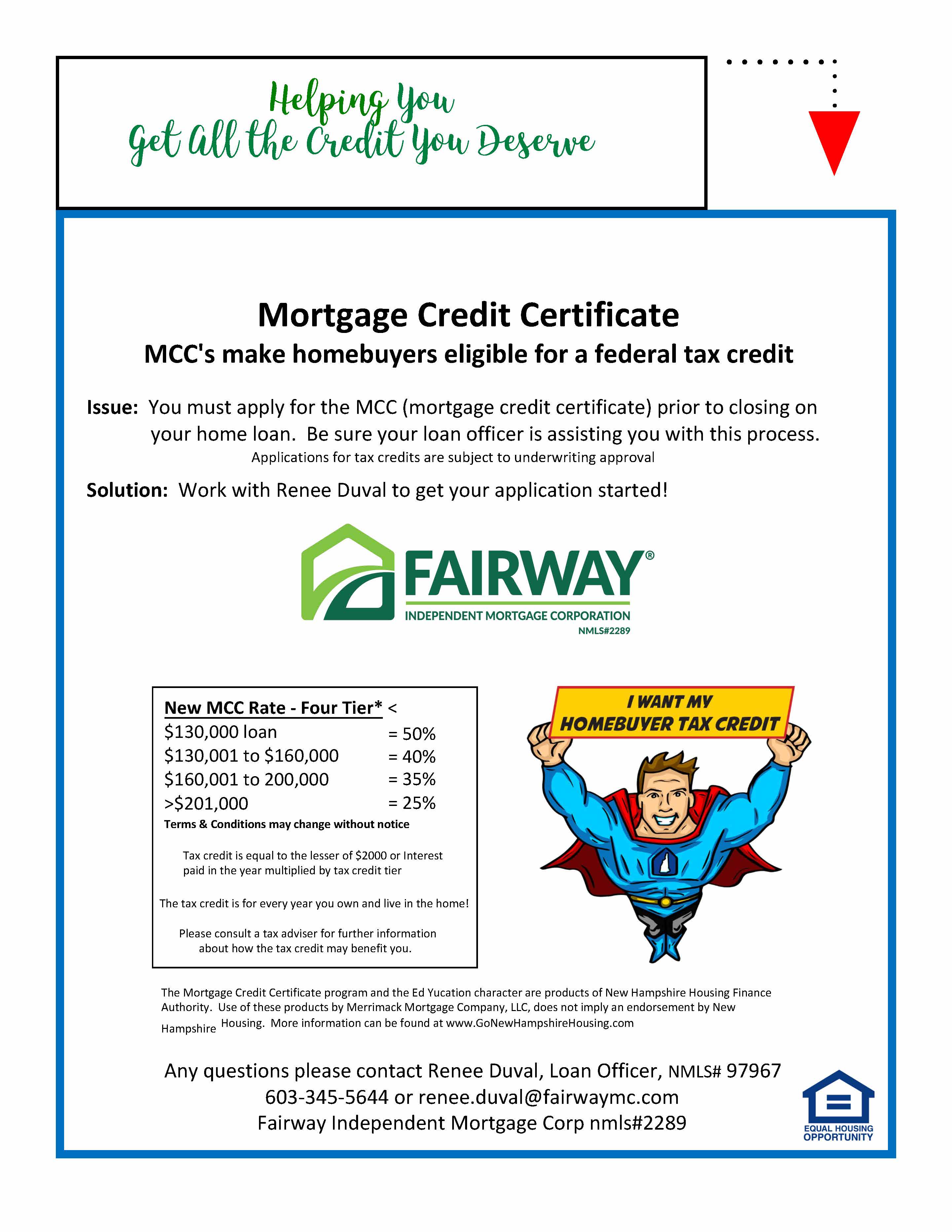

You must enter the amount of property tax paid, the county in which your property is located, and the property number. If you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

If you’re a renter or. If you meet the eligibility. Please do not email any tax credit applications or supporting documentation to the department.

Tax credits have been replaced by universal credit. Examples of these upgrades include:. For the first 24 months of the construction loan, you can deduct the interest payments from your tax bill.

Select the year you are filing for and click continue. Every year, homeowners can apply for a tax credit for 30% of the cost of eligible home efficiency improvements made through the year. However, this only applies if the finished building is your primary or.

There is an opportunity available in montgomery, alabama for a home health, registered nurse (rn). Homeowners' tax credit program p.o. Click on file a ptc rebate application in the box labeled file a return or ptc form.

The application is usually multiple pages and will ask for: How credits and deductions work. Download the pdf application here mail application to:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)