Perfect Info About How To Settle A Collection Account

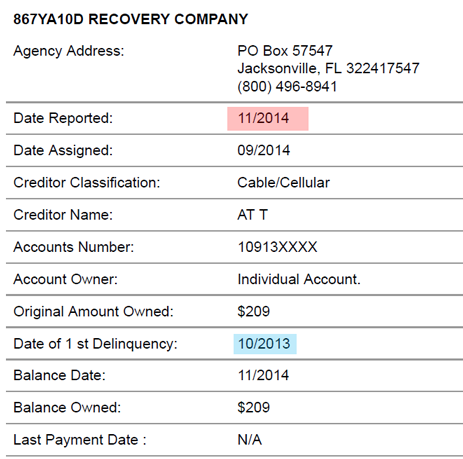

A summary of the full amount you owe.

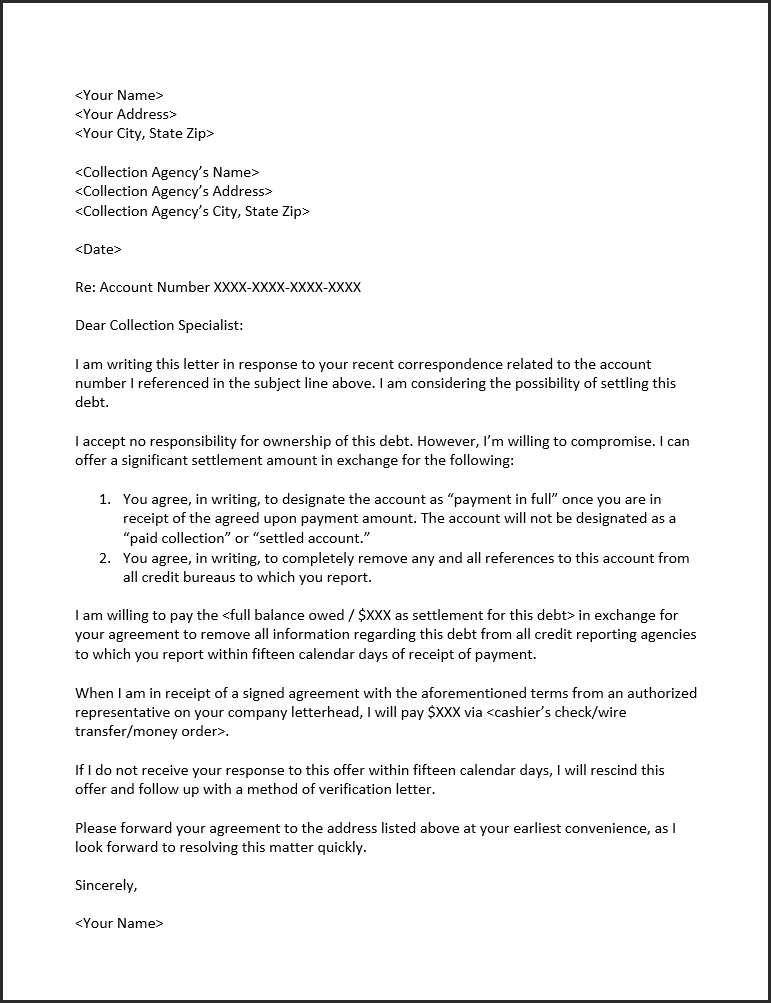

How to settle a collection account. This means you’ll have to report the amount as. Keep copies of everything you send the agency, and everything they send you in a file. Ultimately, a creditor or debt collection agency wants to get its money.

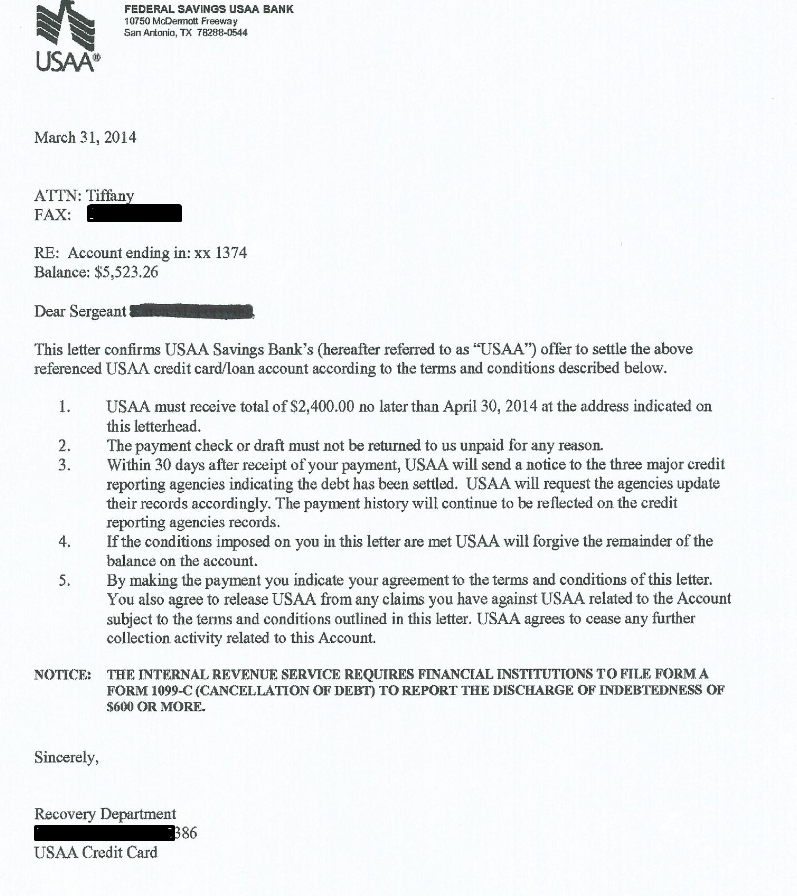

This indicates that the account is closed and that there is no longer a balance due. When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your fico ® 9 and vantagescore 3.0 and 4.0 scores may improve. We already mentioned sending all communication in writing, and we can’t stress.

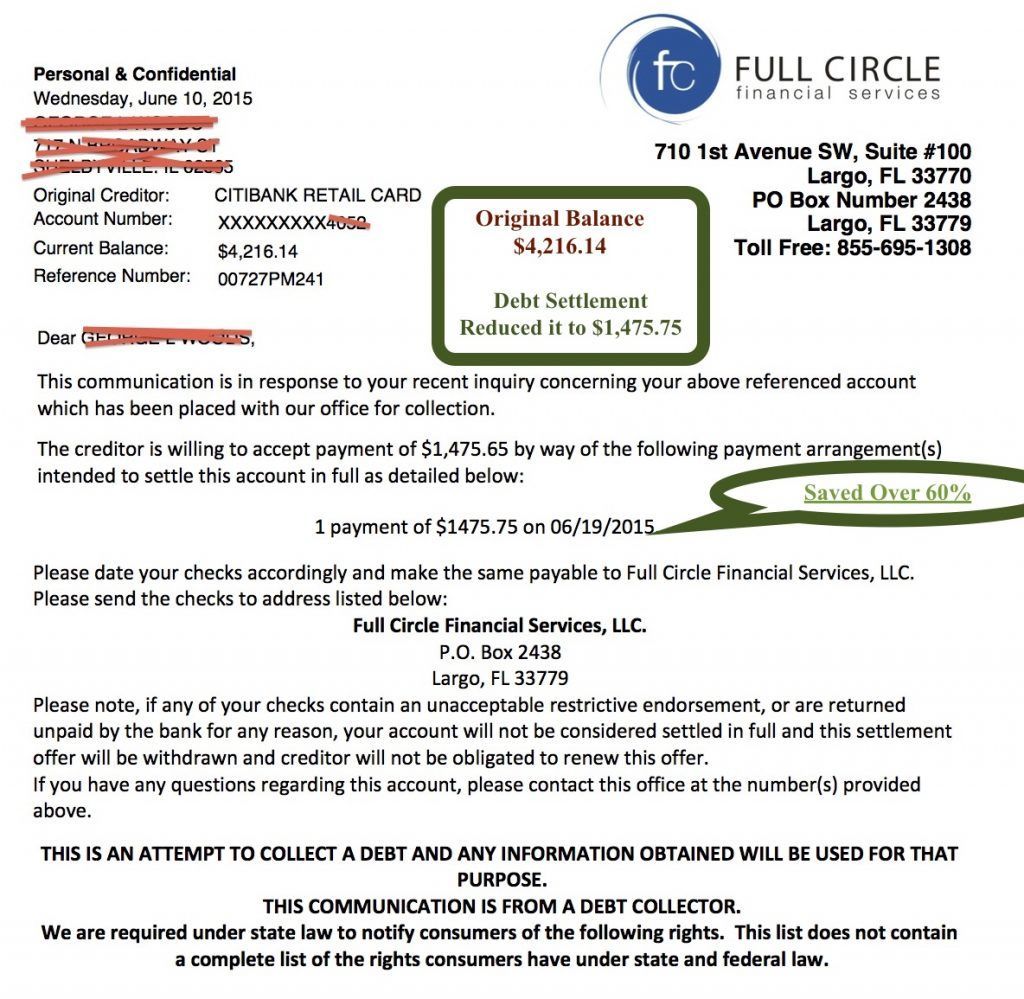

Settle the debt for less than you owe. Lenders aren't fans of any collection entry on your credit reports, but they're likely to view collections with a paid status more positively than. If you’ve decided to settle your medical debts in collections, you have two options:

The name of the original creditor, if it’s a collection account. Watch your debts dwindle sign up. Best practices when settling debts.

What to do if you are facing a debt collection lawsuit. Consider paying any unpaid collection accounts. Find out who owns your debt.

Pay it off in one lump sum. How to dispute a collection account in 4 steps 1. Once you and the agency reach an.

Is it better to settle a collection or pay in full? Get a receipt from the collection agency for what you paid. If your account has already been sent to a collection agency or sold to a debt buyer, contact that agency or debt buyer to see if they can help with a payment plan or settlement amount.

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having. If they cannot provide this information, or the information they provide does. Only communicate with debt collectors in writing & keep records.

Read the entire article by james l. Before you do anything else, find out who your debt collector is. Generally, you will have 30 days to file a response to the summons.

How to settle medical collection accounts. If it's not, you have three main options to pay off a debt in collections: